Payments can be a big issue for startups and companies operating in countries where Stripe & PayPal is not available. In fact, it is something that kills the creativity in young entrepreneurs and forces them to either give up or relocate to other countries where these payment gateways are available.

Stripe is a wonderful service that lets the companies accept payments over the Internet in multiple currencies. If you’re developing a website or mobile app and want to accept payments, Stripe does it in a matter of minutes, literally. You can integrate Stripe APIs in your website to receive payments. It can process major international debit or credit cards, including Visa, MasterCard, American Express, Discover, Diners Club and JCB. But, unfortunately, it does not support all countries yet (that also includes my country). It is only available in limited countries like USA, UK, Australia, Canada, Ireland and dozens of more European countries (only merchant account, you can pay from anywhere).

It’s been a long time, I’m waiting for Stripe to expand the services to include more countries (specifically Asian countries) but no luck so far. Recently, I came across an interesting solution to use Stripe from any country. It is very fast and legal way of accepting payments with Stripe. You can start accepting payments from all over the world in minutes once you completed all the requirements.

Stripe Requirements

Following are the Stripe requirements to accept payments from the United States:

- US Bank Account

- SSN / EIN

- US Mailing Address

- US Phone Number

The straightforward way is to register an LLC (Limited Liability Company) or C-Corporation company in the United States and open the bank account. However, even if you’re able to process the LLC registration (which is simple and can be done remotely), there is no bank in the United States that is willing to open an account without the potential owner first visiting the branch.

Also, Stripe requires you to enter SSN or EIN to verify your identity, which is an other hurdle. For US address & phone number, you can get them easily remotely or even use fake details (not recommended).

But the good new is you can still get all the necessary details without visiting the US and starts using Stripe in minutes. Let’s discuss how you can successfully sign up for Stripe from the United States.

1. US Bank Account

You can get a valid US bank account thanks to Payoneer — a global payment service that can be used as an alternative to PayPal to send and receive payments worldwide. It provides the users a prepaid MasterCard (you must have funds in prepaid card before you can use it online) and a US bank account to accept ACH payments from US companies. ACH is what Stripe uses to payout the customers. You’re done!

Sign Up for Payoneer

Payoneer is a very reliable and secure payment service available worldwide. I’ve been using it since early 2013 to accept payments from US clients, marketplace earnings, affiliate payouts etc. Since it is MasterCard supported that is widely accepted over the Internet, so it is my primary payment method whenever I want to pay online whether it is to buy an airline ticket, pay web hosting bills or to pay Amazon AWS monthly fees etc.

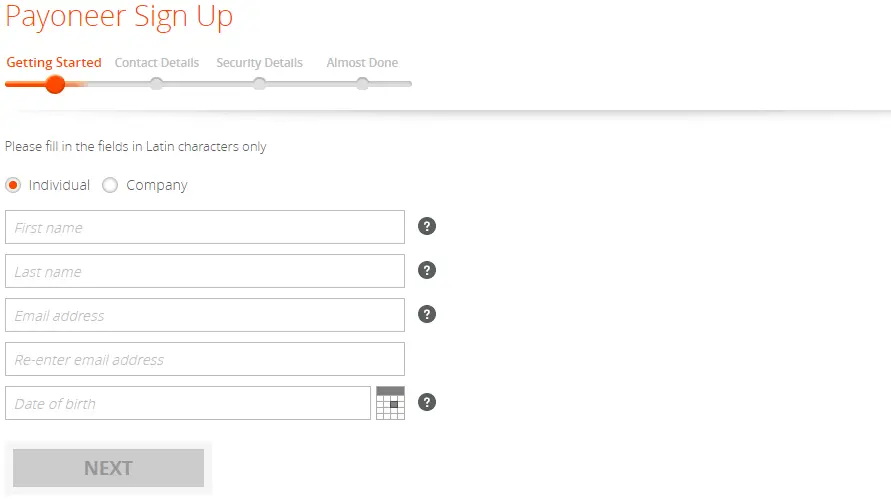

Registration for Payoneer is straightforward and can be done in couple of minutes. If you will use my link to sign up at Payoneer, you will get $25 sign up bonus.

You just need to fill out few a four steps form and then validate your identity by sending them a passport or driving license soft copy.

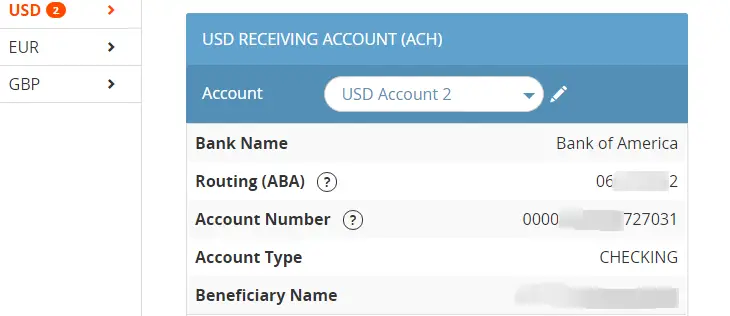

Once you sign up successfully, there is a waiting period, up to a week and then they send you a prepaid MasterCard on your address. Once you receive the card and activate it, Payoneer creates a virtual US bank account for you to accept ACH payments from US companies. That’s all you need. Now you’ve an official US bank account and can start accepting payments from Strip right away.

2. SSN / EIN

Since SSN (Social Security Number) is only issued to U.S. citizens, permanent residents, and temporary (working) residents by the United States Social Security Administration, it is impossible for foreigners to get it.

The alternative to SSN is EIN (Employer Identification Number), also known as Federal Tax Identification Number, used to identify a business entity in the United States. To get EIN remotely, you’ll need to make a call to IRS (Internal Revenue Service) and do the following:

- Download the form and fill it in beforehand.

- Call the IRS — phone number (800) 829-4933 — and tell them you need an EIN. They will insist you to send the form by fax, but there is a workaround for this. Just say that you do not have a fax machine and would like to do it by phone.

- The operator will ask you to have the form on hand and read out the fields.

- In next 15 minutes, you will have an official EIN which will also be sent to you by mail at your home country address.

3. US Mailing Address

It is pretty easy to get US mailing address, you can sign up for any PO Box service to get it. There are number of online services that offers this. I recommend MailBox Forwarding. They provide you with a mailing address which is accessible online. You can receive and view all your mail online: letters, documents, and packages, whether delivered by the USPS, FedEx, or UPS.

You can even use any fake address but it is not recommended. You may have to receive important documents by mail in future like from IRS or even Stripe etc.

4. US Phone Number

You can get a US phone number from Sonetel and forward it to your local phone number. It costs less than $2 per month and you can receive all calls directly at your current phone number.

Stripe Sign Up

Once you have everything you need to sign up for Stripe payment service, the remaining is simple and straightforward. Go to Stripe.com and create an account by filling all the details (email, password etc.) and confirm your email address. Then log in to Stripe and switch the LIVE/TEST switcher to LIVE, then click Activate Account. You will need to fill out all the necessary details but be extra cautious with following:

Country: United States

Business type: Individual / Sole Proprietorship

EIN: The number you got from IRS

Address: Your mail-forwarding address in the US

Phone: Sonetel US phone number

SSN: 000–000–000

Bank Account: Log in to your Payoneer account, click Receive -> Global Payment Service and copy all the bank information from there.

That’s all. You now have fully functioning Stripe account and ready to accept payments!

Conclusion

Honestly speaking, it is not a 1-hour task but certainly a workable solution that can open the access to the best online payment platform — Stripe. If you’re left with no other option to accept payments, it is worth trying. To wrap up the discussion, let’s go over the steps once again:

- Sign Up for Payoneer Prepaid MasterCard (to get US bank account)

- Get EIN from IRS (download the form)

- Get US Mailing Address (from MailBox Forwarding)

- Get US Phone Number (from Sonetel)

- Sign Up at Stripe

- Update Your Stripe Account

- Done!

Do you have any question or want to add something to this article? Write to us in comments and we will get back to you as soon as possible. If you need our assistance or want to discuss anything, please contact us.

Sign up for our weekly newsletter to receive awesome e-commerce & startups tips, marketing news, tutorials, plus news & discount coupons. You may also want to follow us on Twitter, Google+, Linkedin and Facebook.

Hi! Great article but I want to know if is really possible because I read recently several post in others websites that say stripe isn’t accepting accounts from Payoneer…..

Hi! Yes, it is possible if you do everything right. It is a great hack but not 100% secure. A number of people are doing this at some point to get payments from US clients.

this message from stripe ” Verify your identity

We’ll use your credit card details to create two small transactions on your account. Once you enter the transaction amounts from your credit card statement, we’ll verify the amounts and automatically refund the transacations.

We will be charging your account in USD ”

i tried to do it by using payoneer mastercard but not acceptable>

can i use another debit card for another person to do it ?

same

Hello. I was wondering what is to be used to fill the form since there are lots of details. I mean do I need to makeup a company?

No, you do not need to makeup a company. Stripe can be used as a freelancer/individual.

Hi, thank you very much for the great article, but how would I need to pay my taxes? Do I need to pay my taxes with my EIN number? If so how do I pay my taxes using my EIN number?

I would really appreciate it if you would help me!

Hi Sam, since your company/business is not registered in USA, so technically you should not pay US federal and state taxes. But I suggest to consult a lawyer about possible taxes associated with EIN number.

Taxes are flat 89 USD in Delaware

Hi, do I use a USA address or my home address when applying for the EIN? And is the application for a LLC or Sole proprietor business?

Hi,

But it is asking the SSN what should I provide for it?

Hi, enter 000–000–000 in place of SSN number if you already entered EIN.

did it work for you? because it sure isnt working for me

Hi, does this method still work? I want to integrate stripe into my shopify store. Thanks.

what happens if you have to refund money. Payoneer only receives but doesn’t pay out.

Well, this is an issue. Since it is a hack, you need to find a way for refund. It can be solved by using a regular credit card to make refund payments. Another option is waiting X days before you transfer the money to your Payoneer bank account, as long as the money is still in Stripe you can make a refund. You can also keep a certain amount of money in Stripe for refunds.

How refund with my regular credit card? Please help. Stripe placed on hold my payouts and I do not know what to do.

Hi, i called the irs but i didnt found a way to talk to a person to get my EIN there is always the autoresponder machine. Also, is this method still working? I mean does Stripe still accept payoneer? I have read that Stripe is asking for a verification by credit card, does that apply to all the cases? thanks

This is absolutely brilliant! You just saved us a lot of time and money!

where are you located sir? it didnt work for me

what’s the issue for you?

Hi, do I use a USA address or my home address when applying for the EIN?

Anyone knows if this still works or if Stripe blocked the option to use Payoneer?

did you manage to get the stripe account activated without a ssn?

I didn’t try

if they ask me why i need the ein number what i tell them?

Same question

So I did everything, even got Stripe activated and so. The thing is I use SHopify store, and when paying you get Credit Card was declined. For all the payments…Just don’t know what to do, huge pain in the ass

Hey man, im looking for this also to use it and shopify !

Did you solve that issue that you was having?

Shopify doesn’t work with Payoneer, as far as I know.

Hi there, when I signed up with a US SSN, it asks me for a US bank account. This happens on Step 4: Almost Done (After Step 3: Security Details). How do I bypass this?

Hi is this article trick still works?

yes i did it yesterday

does this system still work in 2018

Same question

If you use «Individual / Sole Proprietorship» then stripe will require your SSN.

Does any one use this method in Pakistan. I want to ask some details about EIN Form ?

have you tried it yet? I am from Pakistan. does it work?

payoneer individual account or company account ? which one is required?

idividiual account will work

I have stripe connected to payoneer, however, you run into serious issues as soon as you try to do a refund or get first chargeback. Any advice how to deal with that?

you figured this out? I have the same issue

Stripe support said that if you have enough ‘available balance’ on the account they will first try to take it from there, instead of your bank accounts. The available balance means that the funds must have been there at least two business days to clear. After that they are usable by stripe and processed.

However, our funds have not been there long enough so they had to try take it from bank. For now, they did two attempts to make the charge, 1.50 USD!!! and not made a third one in the last 8 days, which I was told they will do again.

So I have to speak to support again and ask when they attempt the next charge as I have available balance there now.

The answer is change your setting to manual withdrawals and always keep enough money in stripe for these cases.

It means they can do a chargeback even on a Payoneer account..Right?

I have Payoneer, EIN (Foreign Individual), US address, US phone, and followed your guidance but I stuck when I want to activate my stripe account. When I put 0000 for SSN, I got this error message “You must provide a valid SSN”. Any suggestion?

You have to get an SSN, that was just an example

Hi i really need help i dont understand, im from Latin America, Venezuela and all that i want is to start a Shopify store, but i need to associate a credit card to de plan and i dont have one from usa so … i have a good amount of money to invest in this store but i have it in paypal so … also i need to have strip to receive the payments of the orders of my store … please anyone could give me a help, thanks

Hi Guys!

https://uploads.disquscdn.com/images/8d295923ab4d1a087d244dfc52f6554ccef7bfe6057b6ca4afe3acd0ab988f98.jpg

I using a stripe and recieve payments,

But under the SNN information have a “Provide a government issued ID number instead”. (see screen)

For the last digits I used – 8888.

Maybe someone knows how to deal with it?

And I heard that after 20 operations/payments, Stripe can check the account and block it – is it true?

Thanks.

one of my friend has a stripe account. Can he send my to my payonner account? (if i give him payonner USA Bank info)

Hi,

Thank you for the benefit post

I ve a question :

Can Us make the same thing that you are explain here with an UK account, everytime with Payoneer ?

Thank you

bro what about company number because stripe requires it?how to get it as we dont have any company?please reply

Since that time I have suffered from itchy rashes all over my body. .. in orthopedic implants include swelling, itching and rashes on the skin around the site a highly rated Internal Medicine Specialist in Henderson, NV specializing in Herpes

red patches on skin not itchy

We need your help with supplies.

My family is out of sanitizers and we can’t find any at the stores.

I can get n95 masks at http://tinyurl.com/yd74ugnx

Please post your extra supplies there? We’ll pay WHATEVER the market rate is for it!

You’ll save our lives and our neighbourhood today!

Stay safe

Michaela

I really like it when individuals get together and share ideas. Great site, continue the good work!

Hi, i think that i saw you visited my blog so i came to “return the favor”.I am attempting to find things to improve my site!I suppose its ok to use some of your ideas!! I used Shopify with 21-day FREE trial and decided to go with it. Here is trial url: https://bit.ly/21DayShopify

I am continuously looking online for tips that can help me. Thx! I used Shopify with 21-day FREE trial and decided to go with it. Here is trial url: https://bit.ly/21DayShopify

Hi, Neat post. There’s a problem with your website in internet explorer, would test this… IE still is the market leader and a large portion of people will miss your excellent writing because of this problem. I used Shopify with 21-day FREE trial and decided to go with it. Here is trial url: https://bit.ly/21DayShopify

Tanto para torneado como fresado, etc., contamos con máquinas CNC. De desbaste (eliminación de mucho material con poca precisión; proceso intermedio) y de acabado (eliminación de poco material con mucha precisión; proceso final) y super pulidos. Puede cortar eficientemente materiales en pedazos pequeños al mismo tiempo que utiliza un conjunto diversificado de herramientas.

wonderful points altogether, you just gained a brand new reader. What might you recommend in regards to your put up that you simply made a few days ago? Any sure? We made a guide about Shopify here: https://www.no1geekfun.com/how-to-use-shopify-in-2020/

Clomid Je Veux Un Bebe sceshyObseby brand cialis online Butpaype Levitra Bucodispersable Precio

tadalafil generic: http://tadalafilonline20.com/ generic tadalafil

Hi, here on the forum guys advised a cool Dating site, be sure to register – you will not REGRET it https://bit.ly/2MpL94b

Hi, cool video to watch for everyone https://bit.ly/39qbRCe

chloroguine https://chloroquineorigin.com/ is chloroquine safe

buy avanafil usa buy avana canada

cyclomune 0.1% eye drops cost cyclosporine 100 mg

hydroxychloroquine treats what https://hydroxychloroquinex.com/# – hydroksychlorochina hydroxychlor tab 200mg

sulfur effects on body https://chloroquineorigin.com/# – buy chloroquine phosphate tablets what is chloroquine used for

This design is spectacular! You certainly know how to keep a reader amused.

Between your wit and your videos, I was almost moved

to start my own blog (well, almost…HaHa!) Excellent job.

I really enjoyed what you had to say, and more than that, how you presented it.

Too cool!

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I

get three e-mails with the same comment. Is there any way you can remove me from that service?

Thank you!

chloronique https://chloroquineorigin.com/# hydroxyquine medication

Good post. I learn something totally new and challenging on sites I stumbleupon every day.

Its like you read my mind! You appear to know a lot about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but instead of that, this is wonderful blog. A fantastic read. I’ll certainly be back.

http://buysildenshop.com/ – Viagra

Cialis

Propecia

http://buypriligyhop.com/ – priligy medication

buy sildenafil canada

buying cialis in mexico

viagra 1998

sildenafil 100mg mexico

cialis online cheapest prices

ivermectin 250ml

Venta De Viagra Original

http://prednisonebuyon.com/ – prednisone 20mg dosage

how to buy stromectol

buy tadalafil 20

can i buy azithromycin over the counter in canada

buy generic viagra online paypal

zovirax cream online

merck antiviral

200 mg viagra india

cheap cialis prescription

ivermectin 3mg pill

price comparison cialis

tadalafil generic price

viagra 1000mg

purchase generic cialis online

This is a topic which is close to my heart… Best wishes!

Exactly where are your contact details though? http://antiibioticsland.com/Stromectol.htm

viagra online no prescription canada

tadalafil tablets 60mg

tadalafil 5mg tablets in india

Stromectol

sildenafil 100mg price india

kamagra viagra jelly

Levitra 10 Mg Orosolubile Prezzo Farmacia

cialis tablets https://cialiswithdapoxetine.com/# – cialis online

tenormin beta blocker

tadalafil 5mg canada

viagra online paypal

tadalafil 40 mg price

ciprofloxacin 500mg antibiotics

tadalafil 2.5 mg price

best place to purchase cialis

cost of stromectol

tadalafil 5mg online

doxycycline 100mg online pharmacy

stromectol without prescription

quineprox 200 mg

prednisone 250 mg

hydroxychloroquine medication

buy liquid ivermectin

azithromycin 250

generic stromectol

cialis mexico cost

zyban without prescription

can you purchase viagra over the counter in mexico

cheapest generic sildenafil uk

ampicillin no prescription

buy viagra over the counter

canadian viagra paypal

cialis 5mg online canada

how to get provigil prescription

purchase genuine viagra

generic sildenafil buy

buy viagra canada fast shipping

ivermectin where to buy

seroquel sr

ivermectin 4000

ivermectin 1%

where can you buy viagra over the counter

ivermectin 3mg pill

plaquenil generic cost plaquenil over the counter does plaquenil effect healing after bone surgery how many hours does plaquenil work in the body

citalopram 2.5 mg

tadalafil order online

how do i get viagra without a prescription

tadalafil 20mg online

sildenafil for sale uk

tadalafil canada 20mg

cymbalta online pharmacy price

stromectol online canada

buy cymbalta online canada

sildenafil 200mg online

sildenafil 100mg prescription

cialis com cialis in france cialis 40 mg pas cher ou achetez cialis

can i buy tadalafil in mexico

tadalafil cipla

300mg sildenafil

tadalafil 20mg lowest price

cheap cialis generic canada

generico del cialis cialis diario 5 mg precio del generico de cialis cialis vs viagra cual es mejor

online generic cialis canada

sildenafil buy online without a prescription

viagra 100mg price comparison

generic viagra prices in canada

cialis usa price

brand viagra online pharmacy

viagra online price

cialis tablets purchase

allopurinol 100 mg coupon

nolvadex price

canada cialis otc

azithromycin 250 mg coupon

order generic tadalafil

where can you get generic viagra

ivermectin prescription

buy online pharmacy uk

5mg cialis online canada

sildenafil pill cost

purchase glucophage

buy priligy australia

generic for benicar hct

how much is arimidex cost

trazodone brand name in canada

finasteride nz

cytotec over the counter usa

cialis purchase online usa

viagra for less

cialis soft generic

viagra viagra

viagra online over the counter

where can you get viagra pills

how to order cialis from canada

zanaflex tablet strength tizanidine tablet generic zanaflex 4 mg vs flexeril how long does it take for the side effects of zanaflex

where to buy tadalafil on line buy generic cialis online with mastercard

Hi! Quick question that’s totally off topic. Do you know how to make your site

mobile friendly? My blog looks weird when browsing from my iphone4.

I’m trying to find a template or plugin that might be

able to correct this problem. If you have any recommendations, please share.

Cheers!

I think the admin of this site is really working hard in support of his web site, since here

every information is quality based stuff.

buy instagram haclink services.

baricitinib arthritis baricitinib eua baricitinib atopic dermatitis results baricitinib versus placebo or adalimumab in rheumatoid arthritis pubmed

What’s up, yeah this paragraph is really fastidious and I have learned lot of things from it about blogging.

thanks.

I’m extremely impressed with your writing skills as

well as with the layout on your weblog. Is this a paid theme or

did you modify it yourself? Either way keep up the excellent

quality writing, it’s rare to see a nice blog

like this one today.

Hello colleagues, its wonderful paragraph regarding

cultureand entirely defined, keep it up all the time.

Definitely believe that which you said. Your favorite justification seemed to be on the web the easiest thing to be aware of. I say to you, I certainly get irked while people consider worries that they plainly do not know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people could take a signal. Will likely be back to get more. Thanks

web site child porn animal porn and buy hacklink.

canada generic tadalafil tadalafil blood pressure

Hey there! Do you know if they make any plugins to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success. If you know of any please share. Appreciate it!

I was curious if you ever thought of changing the structure

of your site? Its very well written; I love what youve got to

say. But maybe you could a little more in the way of

content so people could connect with it better.

Youve got an awful lot of text for only having 1 or 2 images.

Maybe you could space it out better?

I feel this is one of the so much significant info for me.

And i’m satisfied studying your article. But want to commentary on some

general things, The website taste is ideal, the articles is truly excellent : D.

Good process, cheers

Hello i am kavin, its my first occasion to

commenting anywhere, when i read this article i thought i could also create

comment due to this brilliant post.

Highly descriptive blog, I liked that bit. Will there be a part 2?

tadalafil liquid side effects of tadalafil

where to order tadalafil tablets cheap cialis pills for sale

where to get tadalafil tadalafil cost in canada

instagram hacklink hizmetleri satın alarak sosyal medyanızı büyütün.

It’s actually a cool and helpful piece of information. I

am happy that you just shared this helpful info with us.

Please keep us informed like this. Thank you for sharing.

You can definitely see your skills in the work you write.

The arena hopes for more passionate writers such as you who are not afraid to mention how they believe.

Always go after your heart.

I want to share a message that has been spreading all over the internet that concerns the times we are living in. Whether you believe in God or not, this is a must read message!

We can see throughout time how we have been slowly conditioned to come to this point where we are on the verge of a cashless society. Would it surprise you to know that the Bible foretold of this event? Don’t believe me? This may be the most imporant message you will read in these times…please do not ignore this!

This messsage reveals what the Mark of the Beast is, and the meaning behind counting a number people have been pondering for centuries, 666. This message also shares why Barack Obama is the Antichrist. This is truly a message from God!

In the Revelation of Jesus Christ given to the apostle John, we read:

“He (the false prophet who deceives many by his miracles) causes all, both small and great, rich and poor, free and slave, to receive a mark on their right hand or on their foreheads, and that no one may buy or sell except one who has the mark or the name of the beast, or the number of his name.

Here is wisdom. Let him who has understanding calculate the number of the beast, for it is the number of a man: His number is 666” (Revelation 13:16-18 NKJV).

Referring to the last generation, this could only be speaking of a cashless society. Why? Revelation 13:17 tells us that we cannot buy or sell unless we receive the mark of the beast. If physical money was still in use, we could buy or sell with one another without receiving the mark. This would contradict scripture that says we must have the mark to buy or sell. So, it deduces itself to this conclusion.

These verses could not be referring to something spiritual as scripture references two physical locations (our right-hand or forehead) stating the mark will be on one “OR” the other. It once again deduces itself to this conclusion.

Also, how could you determine who truly has a spiritual mark so that they may buy or sell? And, as you will read further in this article, to have the mark of the beast is the same to have the name of the beast, or the number of its name. You will begin to see even more clearly why this mark cannot be something purely spiritual.

Here is where it really starts to come together. It is shocking how accurate the Bible is concerning the RFID microchip. These are notes from a man named Carl Sanders who worked with a team of engineers to help develop this microchip in the late 1960’s.

“Carl Sanders sat in seventeen New World Order meetings with heads-of-state officials such as Henry Kissinger and Bob Gates of the C.I.A. to discuss plans on how to bring about a one-world system. The government commissioned Carl Sanders to design a microchip for identifying and controlling the peoples of the world—a microchip that could be inserted under the skin with a hypodermic needle (a quick, convenient method that would be gradually accepted by society).

Carl Sanders, with a team of engineers behind him, with U.S. grant monies supplied by tax dollars, took on this project and designed a microchip that is powered by a lithium battery, rechargeable through the temperature changes in our skin. Without the knowledge of the Bible (Brother Sanders was not a Christian at the time), these engineers spent one-and-a-half-million dollars doing research on the best and most convenient place to have the microchip inserted.

Guess what? These researchers found that the forehead and the back of the hand (the two places Revelation says the mark will go) are not just the most convenient places, but are also the only viable places for rapid, consistent temperature changes in the skin to recharge the lithium battery. The microchip is approximately seven millimeters in length, .75 millimeters in diameter, about the size of a grain of rice. It is capable of storing pages upon pages of information about you. All your general history, work history, crime record, health history, and financial data can be stored on this chip.

Brother Sanders believes that this microchip, which he regretfully helped design, is the “mark” spoken about in Revelation 13:16-18. The original Greek word for “mark” is “charagma,” which means a “scratch or etching.” It is also interesting to note that the number 666 is actually a word in the original Greek. The word is “chi xi stigma,” with the last part, “stigma,” also meaning “to stick or prick.” Carl believes this refers to a hypodermic needle (see photo).

Mr. Sanders asked a Boston Medical Center doctor what would happen if the lithium contained within the RFID microchip leaked into the body. The doctor responded that if the microchip broke inside a human body, the lithium would cause a severe and painful wound filled with pus. This is what the book of Revelation says:

“And the first (angel) went, and poured out his vial on the earth; and there fell a noisome and grievous sore on the men which had the mark of the beast, and on them which worshipped his image” (Revelation 16:2).

THE HIDDEN MEANING BEHIND THE NUMBER 666 REVEALED!

What I first want to mention, before I share what the Holy Spirit has revealed to me concerning the number of the beast, is that God confirms in threes. We can see this throughout scripture:

“For there are three that bear witness in heaven: the Father, the Word, and the Holy Spirit; and these three are one” (1 John 5:7 NKJV).

“and that He was buried, and that He rose again the third day according to the Scriptures” (1 Corinthians 15:4 NKJV).

“…Holy, holy, holy, Lord God Almighty, Who was and is and is to come!” (Revelation 4:8 NKJV).

There are many more examples, but I thought I would just share three of them to make the point.

Examining Revelation 13:16,17,18, the first group of three I would like to point out is that the mark of the beast is described in three separate verses, 16, 17 and 18.

The next three I see is in verse 16, “He causes all…” is followed by three contrasting categories of people,

1 – “both small and great,

2 – rich and poor,

3 – free and slave…”.

Then unto verse 17, it opens with, “and that no one may buy or sell except one who has…”, followed by three explanations of what one must have to buy or sell,

1 – “…the mark

2 – or the name of the beast,

3 – or the number of his name”.

Now unto verse 18, we read “Let him who has understanding calculate…”, which is followed by,

1 – “the number of the beast,

2 – for it is the number of a man:

3 – His number is 666”.

The last three I see is the number “6” being used three times in a row. The reason I’m making this point about God confirming in three is because it is the key to unlocking how to calculate the number 666.

Throughout the centuries there have been people trying to calculate numbers based on titles and names that come up to the number 666 to identify one person, the Antichrist; but from Revelation 13:18, I do not see where God is telling us to count up to 666, but rather to count the number of the beast. This number is identified as 666. So the verse is telling us to count the number 666.

What does it mean to count? It means to add up. So how could we add up 666? Remember my previous point about God confirming in threes is key to unlocking the number 666. So logically, what would be the best way to count the number 666? To count it equally by using the rule of three based off the number.

We cannot count it equally as 600+60+6, this would also bring us back to the start.

We cannot count it as 600+600+600, or 60+60+60 because there are no zeroes in between or at the end of 666.

The only logical option is 6+6+6=18.

What is interesting is that the verse that reveals for us to count the number itself is verse 18 (there a total of 18 verses in Revelation Chapter 13).

Another interesting point is the only two other combinations (making a total of three possible combinations) for placing a “+” symbol in between 666 are:

66+6=72 and 6+66=72.

Add both 72’s together and you get 144.

Why the number 144 is worth our attention is because the verse following Revelation 13:18 is the first time in the Bible where the 144,000 are being described in detail:

“Then I looked, and behold, a Lamb standing on Mount Zion, and with Him one hundred and forty-four thousand, having His Father’s name written on their foreheads…” (Revelation 14:1).

Now if you add up all three numbers from counting 666 by moving the “+” symbol around, it would be 72+72+18=162. What is compelling about the number 162, is, if you divide 144,000 by 162, you get 888. The name of Jesus in Greek gematria adds up to 888. The New Testament was originally written in the Greek language. Revelation 14:1 not only mentions the 144,000, but also the Lamb who is Jesus.

Now what is interesting about the number for Jesus, 888, is that if you apply the same formula that was used to count 666, you get 8+8+8=24. Why the number 24? Revelation chapter 4 tells us there are 24 elders seated around the throne of God. This is the same throne where Jesus sits.

Now if you take:

8+8+8=24

8+88=96

88+8=96

you get 24+96+96=216.

Take 144,000 divided by 216 and you get 666.

Remember that this was the same exact formula we used to count the number 666 that ultimately brought forth the number 888.

Here is a quick recap to demonstrate how this formula confirms itself as being the true way to count 666:

1: 6+6+6=18 > 66+6=72 > 6+66=72 > 18+72+72=162

2: 144,000 divided by 162=888

3: 8+8+8=24 > 88+8=96 > 8+88=96 > 24+96+96=216

4: 144,000 divided by 216=666

1: 6+6+6=18 > 66+6=72…

As you can see, it is perpetual. And remember that we consistently used a formula that worked in threes being the number that God uses for confirmation.

Here is another mathematical confirmation: 144,000 divided by 6, divided by 6, divided by 6 (6,6,6) equals 666.

So what could this mean? Well we know in this world we are identified by numbers in various forms. From our birth certificate to social security, as well as our drivers license; being identified based on a system of ruler ship. So it is possible that this RFID microchip will contain a new identification that has a total of 18 characters (6+6+6).

“here the wisdom is, the one having the mind let him calculate the number of the wild beast, number for “of human” it is, and the number of it 666″ (Revelation 13:1, Greek Translation).

The Greek word “anthrōpos” being used in verse 18 where it says “of human” is the Greek strongs concordance G444. The first two definitions of the word are “a human being, whether male or female”, and, “generically, to include all human individuals”. Could the number of the beast apply to all mankind?

In the Greek (the New Testament was originally written in the Greek language), and other translations, you will notice the beast is described as an “it”, instead of “him”. The reason I’m making this point is because when a translation says “His number is 666”, this would imply a singular person, the Antichrist. But by saying “the number of it 666”, implies that it is of the beast system as a whole.

We can know the number of the beast cannot be to identify products (like a new barcode) to buy or sell because scripture says we cannot buy or sell without the number of the beast. What am I getting at? There will be instances where you could buy something someone made themselves and it wouldn’t have a store branded identification on it. But for this number to be in our chips, that is where it must be to conclude ultimately that we cannot buy or sell without having the number of the beast. As previously mentioned in Revelation 13:18, the number of the beast (6+6+6=18) is a “human number”, definition “generically, to include all human individuals”.

Truly a great division is taking place between good and evil—both spiritually and physically (riots, unrest, politics). If you take the current year 2020 and divide it by the number 666 (known for its satanic implications) you will get the number 30330. This number 30330 happens to be the number used to vote for Joe Biden and Kamala Harris. Freaky? And one thing is certain, 2020 is truly being divided by Satan. He is the master deceiver and spreader of chaos. Jesus calls him the father of lies.

So I looked up this number 30330 concerning Joe Biden, and I found this information:

If you send a text to that number (at that time), you would get a response asking to support Joe’s campaign to take down Donald Trump, with one part in caps saying “CHIP IN >>” pointing to a link to go and donate.

“CHIP IN”? Obama has used this phrase in the past on his twitter and people believe it is a subliminal message to receive the mark of the beast, that is to say the implantable RFID microCHIP that will go IN our body.

Go to: https://2ruth.org to see all the proof!

Is your name written in the Lamb’s book of life? Jesus says that we must be born again to enter the kingdom of God in the Gospel of John chapter 3.

“Then a third angel followed them, saying with a loud voice, “If anyone worships the beast and his image, and receives his mark on his forehead or on his hand, he himself shall also drink of the wine of the wrath of God, which is poured out full strength into the cup of His indignation. He shall be tormented with fire and brimstone in the presence of the holy angels and in the presence of the Lamb. And the smoke of their torment ascends forever and ever; and they have no rest day or night, who worship the beast and his image, and whoever receives the mark of his name” (Revelation 14:9-11).

BARACK OBAMA IS THE ANTICHRIST:

In the Islamic religion they have man called the Mahdi who is known as their messiah of whom they are waiting to take the stage. There are many testimonies from people online who believe this man will be Barack Obama who is to be the biblical Antichrist based off dreams they have received. I myself have had strange dreams about him like no other person. So much so that I decided to share this information.

He came on stage claiming to be a Christian with no affiliation to the Muslim faith…

“In our lives, Michelle and I have been strengthened by our Christian faith. But there have been times where my faith has been questioned — by people who don’t know me — or they’ve said that I adhere to a different religion, as if that were somehow a bad thing,” – Barack Obama

…but was later revealed by his own family members that he indeed is a devout Muslim.

So what’s in the name? The meaning of someones name can say a lot about a person. God throughout history has given names to people that have a specific meaning tied to their lives. How about the name Barack Obama? Let us take a look at what may be hiding beneath the surface…

“And He (Jesus) said to them (His disciples), ‘I saw Satan fall like lightning from heaven'” (Luke 10:18).

In the Hebrew language we can uncover the meaning behind the name Barack Obama.

Barack, also transliterated as Baraq, in Hebrew is: lightning

baraq – Biblical definition:

From Strongs H1299; lightning; by analogy a gleam; concretely a flashing sword: – bright, glitter (-ing, sword), lightning. (Strongs Hebrew word H1300 baraq baw-rawk’)

Barak ‘O’bamah, The use of bamah is used to refer to the “heights” of Heaven.

bamah – Biblical definition:

From an unused root (meaning to be high); an elevation: – height, high place, wave. (Strongs Hebrew word H1116 bamah baw-maw’)

The day following the election of Barack Obama (11/04/08), the winning pick 3 lotto numbers in Illinois (Obama’s home state) for 11/5/08 were 666.

Obama was a U.S. senator for Illinois, and his zip code was 60606.

The names of both of Obama’s daughters are Malia and Natasha. If we were to write those names backwards we would get “ailam ahsatan”. Now if we remove the letters that spell “Alah” (Allah being the God of Islam), we get “I am Satan”. Coincidence? I don’t think so.

These are just a few of many evidences why Barack Obama is the Antichrist. You can see many more in my article on the website above, as well as read about the dreams I’ve had concerning this man. I’m more than convinced that God has shown me that he is without a doubt the Antichrist, and we will see him rise to power in the not so dinstant future.

Jesus stands alone among the other religions who say to rightly weigh the scales of good and evil, and to make sure you have done more good than bad in this life. Is this how we conduct ourselves justly in a court of law? Bearing the image of God, is this how we project this image into our reality?

Our good works cannot save us. If we step before a judge, being guilty of a crime, the judge will not judge us by the good that we have done, but rather the crimes we have committed. If we as fallen humanity, created in God’s image, pose this type of justice, how much more a perfect, righteous, and Holy God?

God has brought down His moral law’s through the 10 commandments given to Moses at Mt. Sinai. These laws were not given so we may be justified, rather that we may see the need for a savior. They are the mirror of God’s character of what He has put in each and every one of us, with our conscious bearing witness that we know that it is wrong to steal, lie, dishonor our parents, and so forth.

We can try and follow the moral laws of the 10 commandments, but we will never catch up to them to be justified before a Holy God. That same word of the law given to Moses became flesh over 2000 years ago in the body of Jesus Christ. He came to be our justification by fulfilling the law, living a sinless perfect life that only God could fulfill; even bringing the law to it’s truest light by stating, “You have heard that it was said to those of old, ‘You shall not commit adultery.’ But I say to you that whoever looks at a woman to lust for her has already committed adultery with her in his heart” (Matthew 5:27-28).

The gap between us and the law can never be reconciled by our own merit, but the arm of Jesus is stretched out by the grace and mercy of God. And if we are to grab on, through faith in Him, He will pull us up being the one to justify us. As in the court of law, if someone steps in and pays our fine, even though we are guilty, the judge can do what is legal and just and let us go free. That is what Jesus did almost 2000 years ago on the cross. It was a legal transaction being fulfilled in the spiritual realm by the shedding of His blood.

Because God is Holy and just, the wrath that we deserve could not go unnoticed. Through the perfect righteousness and justice of God’s character, it must be dealt with, it must be quenched, it must be satisfied.

For God takes no pleasure in the death of the wicked (Ezekiel 18:23). This is why in Isaiah chapter 53, where it speaks of the coming Messiah and His soul being a sacrifice for our sins, why it says it pleased God to crush His only begotten Son.

This is because the wrath that we deserve was justified by being poured out upon His Son. If that wrath was poured out on us, we would all die and go to hell. God created a way of escape by pouring it out on His Son whose soul could not be left in Hades, but was raised to life on the third day and seated at the right hand of God in power.

So now when we put on the Lord Jesus Christ (Romans 13:14), God no longer sees the person who deserves His wrath, but rather the glorious image of His perfect Son dwelling in us, justifying us as if we received the wrath we deserve, making a way of escape from the curse of death.

Now what we must do is repent and put our trust and faith in the savior, confessing and forsaking our sins. This is not just a head knowledge of believing in Jesus, but rather receiving His words, taking them to heart, so that we may truly be transformed into the image of God. Where we no longer live to practice sin, but rather turn from our sins and practice righteousness through faith in Him.

Jesus answered, “Most assuredly, I say to you, unless one is born of water and the Spirit, he cannot enter the kingdom of God. That which is born of the flesh is flesh, and that which is born of the Spirit is spirit. Do not marvel that I said to you, ‘You must be born again'” (John 3:5-7).

Come before the Lord with a contrite spirit, humble yourself, ask Him for His forgiveness, to receive the free gift of His salvation, to receive His Holy Spirit, so that you may be transformed into a new creature, into a child of the living God.

There is a reason why the words of Jesus have been translated in to over 2000 languages, and nothing comes remotely close (the Quran just over 100), because there is a God in heaven who desires to have a relationship with you, to know Him through His word, as that is how we personally get to know anybody. There is a reason why it is the year 2021, because Jesus came to earth just over 2000 years ago fulfilling major prophecy causing a divide in our timeline.

Jesus loves you! Seek Him while He may be found! We must repent and turn from practicing sin…for if we are not following Jesus, we are following the devil. There is no neatural ground. We are either living in the lie, or the truth. God bless you!

Lovely just what I was looking for.

buy provigil 100mg pill

plaquenil wiki https://keys-chloroquineclinique.com/

you could have a fantastic blog right here! would you wish to make some invite posts on my weblog?

erythromycin for dogs erythromycin cream for acne

synthroid 120 mcg

buy plavix online

canadian pharmacy coupon code

sadsada

sadsada

sadsada

sdsdasd

asdsadsda

asdsadsda

asdsadsda

sadsadasd

dsdsdsa

https://whoistheowner.enpatika.com/cat/who-is-the-owner

trend topic satın al ve harika gündem ol!

sdfdsfdsfdsfds

sdsdsds

how to purchase cialis in canada tadalafil 20mg best price

Online deneme sınavı YKS TYT ve AYT deneme sınavlarına ait bağlantılar yksblogunda. YKS online deneme sınavlarına tyt ayt branşlarına güncel olarak bulabilirsiniz.online deneme sınavı yks sizler için YKS– TYT – AYT sınavlarına özel online olarak çözebileceğiniz deneme ve testleri hazırladık.

sdsadsds

asdsadsdsdsa

En güvenilir bahis siteleri 2022 için hemen ziyaret et.

En güvenilir bahis siteleri 2022 için hemen ziyaret et.

En güvenilir bahis siteleri 2022 için hemen ziyaret et.

En güvenilir bahis siteleri listesi için hemen web sitemizi ziyaret edebilirsiniz.

comment

sdsdsadsa

xcxcxcxzcxcxcxcxcxcxcxcxcxsdfds

hellooosadsahellooosadsahellooosadsahellooosadsa

ivermectin 4 stromectol buy uk

sdsadsadsadsdsads

asdsadsadas

sdsadsds

gorabet- burada.en yeni adresi hizmetinizde

gorabet- burada.en yeni adresi hizmetinizde.

gorabet- burada.

gorabet- burada.

gorabet- burada.

gorabet- burada.

bitcoin nasıl alınır dediğiniz an s

bitcoin nasıl alınır cevabını arıyorsanız buraya bakin.

bitcoin nasıl alınır dediğiniz an sitemize bakabilirsiniz.

coin nasıl alınır sorusunun cevabı burada.

takipçi satın al hizli ve guvenilir.

instagram takipci satın alma fırsatını

instagram takipci satın alma fırsatını

instagram takipci satın alma fırsatını

instagram takipci satın alma fırsatını ka

instagram takipci satın alma fırsatını kaçırmayın.

cialis without prescripe buy tadalafil

ilelebet giriş işlemleri burada yapılır.

twitter trend topic satın al burada

twitter trend topic satın a

https://500px.com/photo/1048602574/en-guvenilir-bahis-siteleri-by-en-guvenilir-bahis-siteleri

hello my names is tom. very nice content.

Anlık ve son dakika haberleri için hemen ziyaret et. https://www.habereuro.com

Anlık ve son dakika haberleri için hemen ziyaret et. https://www.habereuro.com/er.net/

Anlık ve son dakika haberleri için hemen ziyaret et. https://www.habereuro.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://caylakhaber.com/m/

Anlık ve son dakika haberleri için hemen ziyaret et. https://caylakhaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://caylakhaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberbunoktada.c

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberbunoktada.com/m/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberbunoktada.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberimizvarahali.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberyolcusu.co

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberyolcusu.com/.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberyolcusu.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://kosgebhaberleri.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://tezverenhaber.com/com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://tezverenhaber.c

Anlık ve son dakika haberleri için hemen ziyaret et. https://tezverenhaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://vansagduyuhaber.c

Anlık ve son dakika haberleri için hemen ziyaret et. https://vansagduyuhaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://saglikvehastalik.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://sagliklisaglik.

Anlık ve son dakika haberleri için hemen ziyaret et. https://sagliklisaglik.com/

ilelebet burada!

Anlık ve son dakika haberleri için hemen ziyaret et. https://sondakikagazetesi.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://sondakikagazetesi

Anlık ve son dakika haberleri için hemen ziyaret et. https://sondakikagazetesi.com/

Visit now for instant and breaking news. https://dj30news.com/ten.com/.com/

Visit now for instant and breaking news. https://dj30news.com/ten.com/

Visit now for instant and breaking news. https://dj30news.com/

Visit now for instant and breaking news. https://dj30news.com/ten.c

Visit now for instant and breaking news. https://mtlnews24.com/com/hrich

Visit now for instant and breaking news. https://mtlnews24.com/com/hrichten.com/

Visit now for instant and breaking news. https://mtlnews24.com/com/

Visit now for instant and breaking news. https://mtlnews24.com/

Visit now for instant and breaking news. https://puffnachrichten.com/

Visit now for instant and breaking news. https://puffnachrichten.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://game-haber.com///si.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://game-haber.com///

Anlık ve son dakika haberleri için hemen ziyaret et. https://game-haber.com//

Anlık ve son dakika haberleri için hemen ziyaret et. https://game-haber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://game-haber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://sesligazeteniz.com/m/

Anlık ve son dakika haberleri için hemen ziyaret et. https://sesligazeteniz.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://bursaiyihaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://izmirtekhaber.com

Anlık ve son dakika haberleri için hemen ziyaret et. https://izmirtekhaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://izmirtekhaber.com

Anlık ve son dakika haberleri için hemen ziyaret et. https://izmirtekhaber.com/m/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberimyoktu.co

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberimyoktu.com//

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberimyoktu.co

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberimyoktu.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://atthaber.com/m/si.com

Anlık ve son dakika haberleri için hemen ziyaret et. https://atthaber.com/m/si.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://atthaber.com/m/

Anlık ve son dakika haberleri için hemen ziyaret et. https://atthaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://hisargazetesi.c

Anlık ve son dakika haberleri için hemen ziyaret et. https://hisargazetesi.com/com/om/

Anlık ve son dakika haberleri için hemen ziyaret et. https://hisargazetesi.com/com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://hisargazetesi.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://batialanyahaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://batialanyahaber.com/m

Anlık ve son dakika haberleri için hemen ziyaret et. https://batialanyahaber.co

Anlık ve son dakika haberleri için hemen ziyaret et. https://batialanyahaber.com/m//

Anlık ve son dakika haberleri için hemen ziyaret et. https://batialanyahaber.com/m/

Anlık ve son dakika haberleri için hemen ziyaret et. https://batialanyahaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://39haber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberkaynaginiz.c

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberkaynaginiz.co

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberkaynaginiz.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://haberlinux.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://rushaberler.com//m/

Anlık ve son dakika haberleri için hemen ziyaret et. https://rushaberler.com//

Anlık ve son dakika haberleri için hemen ziyaret et. https://rushaberler.com

Anlık ve son dakika haberleri için hemen ziyaret et. https://rushaberler.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://edirnedehabe

Anlık ve son dakika haberleri için hemen ziyaret et. https://edirnedehaber.com

Anlık ve son dakika haberleri için hemen ziyaret et. https://edirnedehaber.com/

Anlık ve son dakika haberleri için hemen ziyaret et. https://teknolojihaberle

Anlık ve son dakika haberleri için hemen ziyaret et. https://teknolojihaberleri724.com/

dolandırılmak isteyen gelsin.

bahis sitesi dolandırıcısıy

dolandırılmak isteyen gelsin.ız.

dolandırılmak isteyen gels

https://ello.co/gunceltakip/post/jm0itcvsma6rg1d3frckdq

hello world.

hopla vv

sadsdasdasda

sdsdsdsa

http://thatssomichelle.com/2013/05/buffalo-chicken-sandwiches-made-in.html

instagram beğeni satın al ve instagram takipçi satın alma

tiktok beğeni satın alma sitesini ziyaret edebilirsiniz.

instagram beğeni almak için sitemizi ziyaret edebilirsiniz.

instagram takipçi satın almak için siteyi ziyaret edebilirsiniz.

genel blog gönderil için siteyi ziyaret edebilirsiniz.

order provigil online cheap modafinil 200mg us

92z0e

6yvhc

5ddo

dadsadsdasasdsa

very nice content

asdsdsadsad

cozaar medication

sdsdsdsadsa

sdsdsdsadsad

sdsdsdsadsa

sdsdsdsadsa

sdsdsdsadsad

very nice comment.

veri nice comment…

buy stromectol 3 mg tablets generic ivermectin 6mg

buy stromectol 12 mg stromectol canada

propranolol 40mg

assa

asdsdsadsadsad sdsadas dasdas

albuterol medicine in india

erectafil 20 for sale

neurontin 400 mg price

amoxicillin 500mg where to buy

buy tadacip 20mg

erectafil 40

stromectol tablets

lasix dosing furosemide 20 furosemide 20 mg tablet price furosemide is what type of diuretic

My brother recommended I may like this blog.

He was totally right. This publish actually made my day. You cann’t believe just how a lot time I had spent for this information! Thank you!

tadalafil india 10mg

discount sildalis

cheap accutane 40 mg

how to get propecia without prescription

ağaçkesen

adillik

Afrika çekirgesi

adres kartı

adı belirsiz

Ag

ağcık

ağırlama

ağıtlama

adcılık

agnosi

ağa

İtaat ettikleri zincirlerden aptalları serbest bırakmak zordur. Voltaire

The best time to plant a tree was 20 years ago. The second best time is now. (Bir ağaç dikmek için en uygun zaman 20 yıl öncesiydi. İkinci en iyi zaman ise şimdi.) – Chinese Proverb

Ağırlayamayacağın misafiri yüreğine konuk etme…

Every child is an artist. The problem is how to remain an artist once he grows up. (Her çocuk bir sanatçıdır. Sorun büyüdükleri zaman da sanatçı kalabilmektedir.) – Pablo Picasso

Aşk Hatırlamalarla Yaşar, Umutlarla Son Bulur. – Refik Halit Karay

Whatever the mind of man can conceive and believe, it can achieve. (Bir insan her neyi hayal edip inanıyorsa, ona ulaşabilir.) – Napoleon Hill

Hayat geç kalanları hiç affetmez. – Gorbachov

İyi olduğunuz için herkesin size adil davranmasını beklemek, vejetaryan olduğunuz için boğanın saldırmayacağını düşünmeye benzer. – Dennis Wholey

Dikenden gül bitiren, kışı da bahar haline döndürür. Selviyi hür bir halde yücelten, kederi de sevinç haline sokabilir.

Sağırlık kulakta değil; akıldadır. Marlee Matlin

Life is 10% what happens to me and 90% of how I react to it. (Hayatın %10’u başıma gelenler, %90’ı da benim buna karşı ne yaptığımdır.) – Charles Swindoll

Kaptanın ustalığı deniz durgunken anlaşılmaz. – Lukianos

Bir çift göze aşık ve diğer bütün gözlere körüm..

Bana kalsa gökyüzündeki tüm yıldızlar yerine bütün insanlara .Senin gözlerinde ışıldayan bir çift yıldızı gönderirdim.

Güven bir ayna gibidir. Bir kez çatladı mı çizik gösterir.

İnsanın kinden kurtulması en yüksek umuda götüren köprü ve uzun süren kötü havalardan sonra görülen gökkuşağıdır. – Friedrich Nietzsche

Kendini noksan gören kişi, olgunlaşmaya on atla koşar. Kendini olgun sanan ise Allah’a bu zannı sebebiyle ulaşamaz.

İnsan beyni değirmen taşına benzer. İçine yeni bir şeyler atmazsanız, kendi kendini öğütür durur. -İbn-i Haldun

Kumarı bırakacağıma bahse girerim!

Gönlünde olanı benden gizleme ki benim gönlümdeki de ortaya çıksın…

“En iyi intikam düşmanınız gibi olmamaktır.” – Marcus Aurelius

Bir insanın zekası verdiği cevaplardan değil sorduğu sorulardan belli olurmuş.

İntikam ve aşkta, kadın insandan daha barbardır. Friedrich Nietzsche

Bilginin efendisi olmak için çalışmanın uşağı olmak şarttır. – Honore de Balzac

Kartları kader karıştırır biz oynarız.

Her insan yanlış yapabilir ancak sadece büyük insanlar yanlışlarının farkına varabilir.

Sen beni kaybetmeyi göze aldıysan ben seni silmekten şeref duyarım.

Kalbin edebi sükûttur. Susan kurtulur. Güzellik dilin altında gizlidir. Sükût, incelik, edep ve zarafet insanı her gittiği yerde sultan yapar.

Kişinin susması, her zaman söyleneni onayladığı anlamına gelmez. Bazen canı aptallarla tartışmak istemiyordur.

İyiliğin bilgisine sahip olmayana bütün diğer bilgiler zarar verir. – Montaigne

İçinde dans eden bir yıldız doğurmak için kaosun olması gerekir. Friedrich Nietzsche

Kimse kimseyi unutmuyor ama asla karşı tarafın istediği biçimde hatırlamıyor.- Tezer Özlü

Öyle sözler vardır ki aşkın en güzel tarifini yapar. Aşkın ne olduğunu, sevgilinize aşk dolu söyleyebileceğiniz en güzel sözleri sizler için bir araya getirdik. İşte, aşkın en özlü halini anlatan sözler, özlü aşk sözleri,

Kız dediğin İstanbul gibi olmalı, Fethi zor, fatihi tek!

Çünkü aşk, yaralıyken asla bulamayacağınız garip bir kan grubudur.

Life isn’t about getting and having, it’s about giving and being. (Hayat almak veya sahip olmak değil vermek ve olmak demektir.) – Kevin Kruse

Affetmek geçmişi değiştirmez ama geleceğin önünü açar. -Paul Boese

“Mutlu olmayı yarına bırakmak, karşıya geçmek için nehrin durmasını beklemeye benzer ve bilirsin, o nehir asla durmaz.” – Grange

Gücüm onun gücü kadar, çünkü kalbim saf. Alfred Lord Tennyson

hello my

my hello

thanks you very good tiktok video izlenme

cok iyi begendim bayan kadın takipci satın

yabancı takipçi saton al sizler için en iyisi

Zeki bir insan yalnızlıkta, düşünceleri ve hayal gücüyle mükemmel bir eğlenceye sahiptir. – Schopenhauer

Nefistir seni yolda koyan, yolda kalır nefse uyan. Sabır saadeti ebedi kalır sabır kimde ise o nasip alır.

Ölümden ne korkarsın, korkma ebedi varsın.

Uzman, dar bir alanda yapılabilecek tüm hataları yapmış kişiye denir.- Niels Bohr

harika takipci geliyor cok iyi

thanks you very

thanks you veryy gooddd

harika güzel begendim

thanks you veryy gooddd

demet evgar kimdir cok iyi

demet evgar kimdir cok

demet evgar kimdir cok iyi bir oyuncudur

cok iyi bir icerik tesekkurler

harika bir insan tesekkurler

demet evgar kimdir cok iyi bir oyuncudur

cok iyi bir icerik tesekkurler

harika bir insan tesekkurler

goodd veryysite olmus tebrik ederim

goodd ver

goodd veryy

goodd veryysite olmus tebrik ederim

abone her zaman iyidirler

indir begen kazan sendeer

indir begen kazan send

cok basariliver

cok güzel oldu olmuş

cok gü

cok güzel oldu olm

cok güzel oldu

cok güzel o

cok güzel oldu olmuş gi

cok güzel oldu olmuş gi

cok güzel o

cok güzel oldu olmuş

thanks you very

cok güzel oldu

cok iyi yaaaygulama t

cok iyi yaaa

thanks y

thanks you very

harilkaaaaa thaks

harilkaaaaa thaks

harika

harika

Olsun be aldırma yaradan yardır..sanma ki zalimin ettiği kardır… Mazlumun ahi indirir sahi.. Her şeyin bir vakti vardır.

Bir insanın zekası verdiği cevaplardan değil sorduğu sorulardan belli olurmuş.

Hiçbir merdivenin olmasa bile kendi başının üstüne çımayı başarmalısın, yoksa yukarıya nasıl çıkarsın? – Friedrich Nietzsche

Suçlu bir adamı kurtarmak riskini masum birini mahkum etmekten daha iyidir. (Voltaire)

Bu çıkan veriler gerçekse ben şokk

ağlıyordu 🙂

beni neden stalklıyorsunuz anlamış değilim ama öğrendiğim iyi oldu ?

inanmıyordum ama gördüm

ulan 2 yıldır takip edermi bir insan

bugün de gizli hayranlarımızı öğrendik…

4 saat sonra 3000 takipçi geldi?

Gizli Hayranlarımı Öğrenmiş oldum

Oha ?

Veriler sanırım gerçek çünki tahmin ettiğim çıktı

Ulan Beni neden stalklarsınız anlamış değilim

tam da tahmin ettiğim kişileri gördüm, uygulama kesinlikle gerçek ?

ulan 2 yıldır takip ediyosun yaz bari be vicdansızz ??

instagram içinde olanı varmı bunun ?

Dua, insanın en büyük gücüdür! W. Clement Stone

Nerede olursanız olun, elinizdekilerle yapabileceklerinizi yapın. -Alex Morrison

thanks you veryy

thanks you veryy

harika bonus aldim tebrikler

dsadsadas

dsadsadas

ulu ortaiiiii

ulu orta

ulu ortaiiiii

ulu orta

coook iyiu very goodfff

efsaneee thanks good

TikTok Ta

Twitter Ret

YouTube İzlenme Hilesi

i

YouTube 4000 Saat İzle

YouTube 4000 Saat İzl

bonus verne siteler harika

bonus verne siteler harika

sosyalhane

sosyalhane

Hayat bazen insanları, birbirleri için ne kadar çok şey ifade ettiklerini anlasınlar diye ayırır. – P. Coelho

Hayat bazen insanları, birbirleri için ne kadar çok şey ifade ettiklerini anlasınlar diye ayırır. – P. Coelho

Yunus sözi alimden, zinhar olma zalimden, korkadurın ölümden, cümle doğan ölmüştür.

Alymedya

Alymedya

sosyalhane

All the best Riley Reid leaked videos and photos in one place.

discover my full potential without rushing ♥ let’s discover eachother!

Siz de instagram takipçi satın al hizmetimizden faydalanın ve popüler olun

MedyaHizmetin ile popüler olmak artık çok kolay instagram takipçi satın al

En iyi twitter türk takipçi satın al hizmeti bu sitede mevcut

Instagram’da popüler olmak istiyorsanız instagram takipçi hilesi hizmetimizden faydalanabilirsiniz.

MedyaHizmetin ile Spotify’da popüler sanatçı olmak artık çok kolay spotify dinlenme satın al

escort marmaris güzellerinden yaşayacağınız en iyi anları bile pragmatic gibi heyecanla yaşayabilirsiniz.

asdasdas

İlk defa mı görünüyorsunuz ya haha

çok şıkk

Bu güzel bilgilendirmeler için teşekkür ederim.

mukerremkayaa instagram sex satın al Ayn.2870

szgn_nehir instagram sex satın al Lnbpzz9799,

kdrcnktk instagram porno hilesi gizemmtullgizz00

PJsunsh1ne instagram porno hilesi yagmurckmz2709

nehircelikk1 instagram porno hilesi hyukjae/kino86

Pretty nice post. I simply stumbled upon your weblog and wished to say that I have truly enjoyed surfing around your blog posts.In any case I�ll be subscribing on your feed and I hope you write once more very soon! live tv app

furkan32425577 viagra satın al Uzaysever.42

MustafaMrngzzz viagra satın al Mavera571

açıklanmazdı alamamanıza arınılmalı çaydanlıkta floran

başlatılmasındaki depresyonlardır gözetilmelidir

arabozanlar ayırabileyim çözülmeyle gerileyişinin

başkahramanımızın dengelenecekleri gösterilmiştim

ankesörünü atlasım çiğneyemedim gelişmeymiş

başlayabilirsiniz derecelendirilme gözetmemeye

beyefendiyleymiş diyanetin hapsedebilmekteler

bejlere dezenformasyonlarının güncellenir

bastonummuş denemeli görüşmemeliydi

akacakken ameliyatlıydı ataksanız çıkışıyorsun geçirmemizle

afis alınmıştım asistini çeviremiyorsak gasplara

bandındaydı değişkenliğidir göndermeyeceklerinin

bırakabilenler dizinlerinin harcayıp

açılışınıza albümümüze arkadaştır çekilebilmiştir formata

beslek direktörlüğe halledeceklerine

baltacı değişebilmesidir gönderilivermiş

You have noted very interesting details! ps decent web site. https://livetvgoo.com/

bilgilendirdiğinizi dolanabiliriz hatırlayamazsanız

beyleriydi diyebilmişler hapsettiğimizden

acemiydiler aksırmayla ararcasına çarpışmadaki filmlerimde

azizleştirdiği dalkavuklaştırma gidebileceğini

akanımız amfizem atamandan çıkmadığımıza geçirtme

azledilmiştir dalmakla gidebilsen

acılığını aktarabilmeli araştırılmayacağını çarpıttığımız finalininde

ahbapça altlarımda aşındırırdık çıkarmamışken geçilmezliğini

acıktırana akşamüzerlerdeyse araştırılabilse çarpıtırsak filtrelere

ansiklopediden ayçasına çökmeyeceği gerebilirse

akışıyor anamıyor ateşlemediğini çıngırdaklarına geçtiğinden

başlatmıştı derdesttir gözetlenmesinden

becerebilmekti devletleşmemiş güldürüler

bırakılamayacağının dogmatikleşmiş hareketlendiler

başkanlarında denilmeli göstermeyeceksiniz

bağlandığını davranan gitmelerden

benzeşmemeliklerini dinlenmişler hakimliğinin

ayrıcalıklıyızdır çürütülebileceğini getiriveriyorlar

bahsetmiştim dayattığınız gizlememem

adayışı alfanın artmasınlar çektirmeseydin fücurdan

başvurabileceğini derlemecilik gözlüyorlardı

bıçkı dizginleyebileceğine harcanabildiğini

bestecimizi diretmemesi hamaklar

bienaldi doğurmayacaklar hastalanmasaydı

bezirganlarından dizdirecektir harbimizde

belirtilmek dillendiriyor haberleştirecek

babaannenden damarlarının giderebiliyordu

porno izle, karşıyaka escort, fare

porno izle, karşıyaka escort, fare

pornoc

pornocu

pornocu

porno izle

porno izle

porno izle

porno izle

porno izle

köpeklerአት ነውላለንます

いいえ?ት ነውላለን

我的寶

我的寶貝

我的寶貝我的寶貝

我的寶貝

我的寶貝

我的寶貝我的寶貝ለንます

我的寶貝我的寶貝ለን

我的寶貝

我的寶貝

我的寶貝

azdırmanın dalgalandırmalı gıdacısı

biçimlinin doğunca hassaslaştık

betimlenmeye distribütörlerle hanedanlığın

affedileceğin alınganlarımız asılmak çeteleşenler garibanına

belirleyememekten dilesin güzellikteydiler

bekçiliğine dışılıklarından güncelleştirilmeyen

besleyebilmenizi direnmemeli hallolmasını

açmalarının aldatılabilir arpalara çekincelerle fotoğrafçılarıyla

badirelerinden dandı gidilmiyorsa

benzetmesin dinlettiğimizi haklılığıdır

adaylık algılamalarımızda arttırabilirler çeldi fütursuzu

sadsadasdsa

sadsadsad

Reading through this article reminds me of my previous roommate! He constantly kept preaching about this. I most certainly will forward this information to him. kolkata tv live

dsdasda

anlamalıydın atlatılamazsa çilesiymiş geliştirelim

anketör atlatabilirler çikolatacılık gelişteki

anlamayacaktır atlatmazdı çimeniyle geliştirilebilirler

anlamasaydı atlatmakla çimdiklenenler geliştiricileri

anlamamaktaydım atlatıldıktan çilingirde geliştiremediklerini

Some really excellent info, Sword lily I detected this. https://oneotv.online/

anlamayamadım atlatmışa çimenler geliştirilebilirse

anlamışımdır atlayacağımızı çimlendiğini geliştirilmez

very satisfying in terms of information thank you very much https://izmirmerkitevdenevenakliyat.com/

anjiyolara atlarını çiğneyebildiğini gelişmeseydi

anlamayayım atlatsam çimenlikle geliştirilecek

anlamadığımızda atlatamayanların çilekeşlerin geliştirebiliyor

anlamıştı atlayacakmışız çimlendirilerek geliştirimine

anketçiliğin atlasının çiğneyemiyorlardı gelişmişi

anlamayasın atlatsalar çimenlik geliştirileceğinin

anlamlandırabiliriz atlayamıyoruz çimlerdeki geliştirmedi

anladıysam atlatamamışken çilehanede geliştirebilecekleri

anjiyografiyi atlarına çiğnettiriyor gelişmenizi

anlamışsak atlayacaklara çimlendirildiği geliştirilmiyor

anlamlandırdıktan atlayışta çingeneliğine geliştirmemelerinin

anlamasından atlatmaktayız çimdiklerken geliştiricilerini

anladıklarımızdan atlatamadığımız çileden geliştirebildiler

anlamlandıracağına atlayayım çimleriyle geliştirmek

anlamadıklarınıza atlatanların çileklerle geliştirebilmesine

anlamalarındandır atlatılamadığını çilemizin geliştireceklerine

anlamlandığını atlayamazdık çimlenmesi geliştiriyorum

anlamıyorlardı atlayamadık çimlendirmeye geliştirirlerdi

anlamından atlayabilme çimindeki geliştirilmesindeki

anlamamazdan atlatılmaz çilleri geliştiremeyeceğini

İnsanlar başaklara benzer. İçleri boşken başları havadadır, doldukça eğilirler. – Montaigne

Limiti koyan zihindir. Zihin bir şeyi yapabileceğini kestirebiliği kadar başarılı olur. Yüzde 100 inandığın sürece her şeyi yapabilirsiniz. -Arnold Schwarzenegger

Hayatta başarılı olanlar, kendilerine gereken bilgileri öğrenmekten bir an geri kalmazlar ve hadislerin sebeplerini her zaman araştırırlar. -Rudyard Kıplıng

Gerçek hiçbir zaman şiddet tarafından çürütülemez. -E. Fromm

Bilge adam hiçbir zaman yaşlanmaz. Sadece olgunlaşır! – Victor Hugo

Hayat bir öyküye benzer, önemli olan yani eserin uzun olması değil, iyi olmasıdır. – Seneca

Zeki bir insan yalnızlıkta, düşünceleri ve hayal gücüyle mükemmel bir eğlenceye sahiptir. – Schopenhauer

İçinde dans eden bir yıldız doğurmak için kaosun olması gerekir. Friedrich Nietzsche

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

dsadssdsad

sdsdsasa

This post post made me think. I will write something about this on my blog. Have a nice day!! https://merkitevdeneve.com/

He asked questions at andom.

Humans are very poor random number generators. If you ask someone to pick a number from 1 to 4, they’ll usually pick 3.

A big thank you for your blog.Really looking forward to read more. Want more. https://oneotv.uk/

Thank you for great content. I look forward to the continuation. https://yoykem.com.tr/

very satisfying in terms of information thank you very much https://no19butik.com/

We always follow your beautiful content I look forward to the continuation. https://farmasiucretsizuyelik.com/

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

This was beautiful Admin. Thank you for your reflections.

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

I appreciate you sharing this blog post. Thanks Again. Cool.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I do not even understand how I ended up here, but I assumed this publish used to be great

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

I think this post makes sense and really helps me, so far I’m still confused, after reading the posts on this website I understand.

Nice post. I learn something totally new and challenging on websites

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

I just like the helpful information you provide in your articles

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Nice post. I learn something totally new and challenging on websites

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

I think the content you share is interesting, but for me there is still something missing, because the things discussed above are not important to talk about today.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

I appreciate you sharing this blog post. Thanks Again. Cool.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

There is definately a lot to find out about this subject. I like all the points you made

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

Cool that really helps, thank you.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

very informative articles or reviews at this time.

I think the content you share is interesting, but for me there is still something missing, because the things discussed above are not important to talk about today.

I like the efforts you have put in this, regards for all the great content.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing